STUDIO PROFIT REPORT: NETFLIX REIGNS, PARAMOUNT AND SONY GAIN

FILM INDUSTRY NEWS WEEKLY DIGEST, WEDNESDAY MARCH 10TH

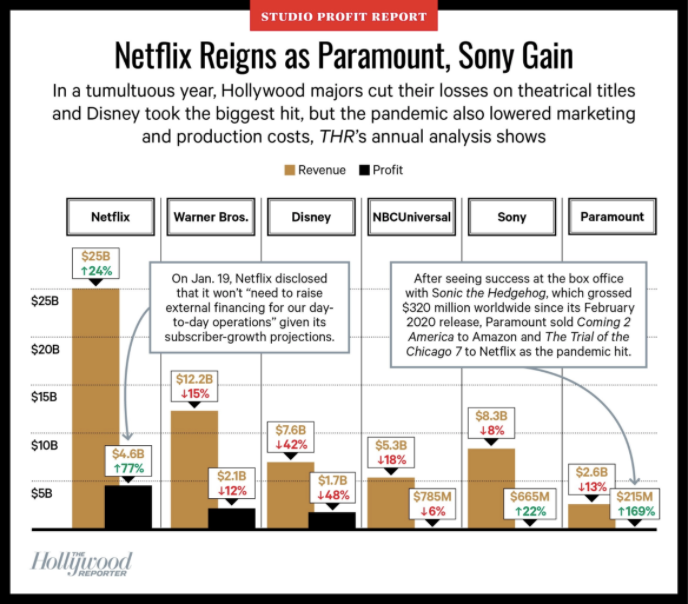

Studio Profit Report: Netflix Reigns, Paramount and Sony Gain

Hollywood studios’ profits in many cases dropped despite lower production and other expenses and cost cuts, including layoffs. Warner Bros. overtook Disney in The Hollywood Reporter's annual film unit profit table, but the latter changed its reporting structure, starting with the final quarter of 2020, amid an increased focus on streaming.For the second year, the annual analysis includes an educative look at streaming giant Netflix, whose financials are not directly comparable to those of the studio units of entertainment conglomerates (for example, its revenue comes from subscribers that Hollywood giants typically record outside their studio units), but which increasingly competes for talent, content and awards. Financial disclosures for studios remain limited and not easily comparable as Warner, Sony and ViacomCBS’ studio arms include TV production units, which others don’t have. THR crunched figures for the calendar years 2020 and 2019 to enable a comparison, even though Disney and Sony have fiscal years that don’t align with the calendar year. Nonetheless, the ranking gives a snapshot of the business of major studios at conglomerates at a challenging time for Hollywood.https://www.hollywoodreporter.com/news/studio-profit-report-netflix-reigns-paramount-and-sony-gain

Netflix Strikes EFM Record $55M Worldwide Deal For Christian Bale Cross Creek Thriller ‘The Pale Blue Eye’

The streaming giant has been on a buying spree at this year's all-virtual European Film Market, previously signing a pair of 8-figure deals: paying a reported $15 million for North America and Latin America rights to Colin Firth World War II movie Operation Mincemeat from The King’s Speech producer See-Saw and Cohen Media Group, and dropping $18 million for U.S. rights to Liam Neeson-Laurence Fishburne action-thriller The Ice Road. https://deadline.com/2021/03/netflix-christian-bale-pale-blue-eye-record-efm-deal-1234707264/

Box Office Pops Upon New York City Theaters Reopening

By early afternoon on Friday, numerous showings of Disney's new animated pic Raya and the Last Dragon were sold out at AMC 19th Street in Manhattan. Ditto for Searchlight's specialty pic Nomadland.The multiplex was among dozens of cinemas across New York City — including the country's busiest theater, the AMC Empire 25 in Times Square — that reopened on Friday after nearly a year of being shuttered because of the pandemic.If early estimates hold, box office revenue for the weekend should be up as much as 14 percent over the previous weekend. While the overall number is still low compared to other years, the outlook is improving. https://www.hollywoodreporter.com/news/box-office-pops-upon-new-york-city-theaters-reopening

‘Raya And The Last Dragon’ Debuting To $8M As Pic Hits Disney+ & NYC Reopens: Why The Industry Is Greatly Concerned

Disney did not reach a deal with No. 3 chain Cinemark, as we first told you (thus, losing around 250 bookings), Harkins, and Canada’s Cineplex. a studio-reported $2.5M Friday and an industry weekend estimate of $8.3M at 2,045 theaters. These numbers are slightly less than the $3M Friday and $9M-$10M we were hearing about, and they’re definitely less than the $14.1M that Warner Bros’ same day HBO Max release of Tom & Jerry posted last weekend. What’s scaring many about Raya is that Disney gets to keep 100% of whatever they’re making from the $30 Disney+ PVOD purchase of Raya. Disney doesn’t have to split that PVOD revenue with any exhibitor. It was explained to me that Raya‘s $30 price point on Disney+ is roughly equivalent to the rental that Disney would get from five or six movie tickets. Wow. While I’ve heard Warner Bros. has been a partner with exhibition, and has made a deal on terms for their same day HBO Max titles. Disney hasn’t budged. https://deadline.com/2021/03/raya-and-the-last-dragon-opening-weekend-box-office-new-york-city-disney-1234708406/

AMC Entertainment CEO Adam Aron’s Compensation Doubled to $20.9M In 2020 Amid Shutdown

According to the company’s SEC filing Friday, Aron’s package in 2002 included a base salary of $1.1 million, a bonus of $5 million and stock award of $14.8 million. The company pre-announced the bonus — there was no bonus in either 2018 or 2019 — citing Aron’s efforts to keep the struggling exhibitor afloat during a global pandemic that shuttered theaters. The circuit, which was close to bankruptcy, was saved by a capital raise late last year and love from retail investors on Reddit….movie theaters closed in March 2020… With theaters dark, the company eventually had to furlough about 30,000 people and has been bringing them back on slowly as theaters reopened in parts of the country. https://deadline.com/2021/03/amc-entertainment-adam-aron-compensation-2020-coronavirus-1234708257/

Europe’s New Rules of Engagement With Streamers Making Slow But Steady Progress

The EU’s game-changing Audiovisual Media Services Directive, which is expected to prompt new rules of engagement between producers and streaming giants, is finally in various stages of implementation across Europe. The new rules — for which the formal deadline was January 2021, but there is some leeway — will involve investment obligations and in some countries, setting out terms of trade for streamers.At its core the directive simply states that streamers must offer a 30% quota of European content to European subscribers starting in 2021. But on top of that, EU countries are introducing nationally tailored legislation to make streamers directly re-invest a percentage of their revenues in each European country where they operate. And some countries — such as France and Italy — are in the process of enshrining into law new rules that will also force Netflix, Amazon Prime, Disney Plus and other streaming services to invest locally through independent producers and ensure that producers will retain a portion of the rights. https://variety.com/2021/digital/news/europe-avms-streamers-1234915013/

How Kids Television Became the Most Heated Front in the Streaming Wars

“You can see that streamers are snapping up popular intellectual property and that studios are competing heavily for talent,” says Olivier Dumont, president of family brands for eOne, the large Hasbro-owned production company behind such kids series as “Peppa Pig” and “PJ Masks.” While new programming aimed at adults tends to get the lion’s share of publicity from the streaming world, executives behind the scenes readily acknowledge that movies from Martin Scorsese, a new cut of “Justice League” or a new series from Shonda Rhimes can only go so far to keep viewers from “churning,” or canceling their subscriptions. These executives say properties aimed at kids, young adults and families tend to create the sorts of lasting relationships that keep subscriber money coming in every month.A survey of 3,000 U.S. adults conducted in the fall by nScreenMedia, a broadband consultancy, found that 75% of parents watch video with their children several times a week or more. Two-thirds of respondents indicated they expect time spent with kids watching TV and movies to stay the same or increase once the pandemic ends.…every kids TV executive knows that a successful character or concept can also drive millions of dollars’ worth in dolls, T-shirts, books and other consumer products. https://variety.com/2021/tv/news/kids-television-streaming-netflix-apple-disney-nickelodeon-1234891622/

EFM Kicks Off Amid Kill Fee Concerns

growing frustration felt by a number of international buyers who are unhappy about being unwound by sales firms and packaging agents from high-profile movies in favour of streamers. Most industry we speak to are frustrated one year into the wearying pandemic so a level of anxiety and angst is to be expected from theatrical distributors who have been at the sharp end of Covid. A number of these dealmakers tell us they are frustrated about being “dangled” enticing projects (such as Emancipation), only for them to be sold to streamers after they’ve spent time and effort putting in bids and generating heat for the packages…Even more frustrating to them, we are told, is when they help a movie get financed through pre-sales and then it’s pulled from under their feet at the eleventh hour, as happened on The Trial Of The Chicago Seven, and in their minds, most egregiously, on Sundance hit Coda, which was pledged to dozens of indie buyers years ago but was suddenly sold to Apple for world rights in a huge Sundance deal which blindsided many.Buyers are most worried about a scenario in which sellers and packagers insist across the board on so-called ‘buy-back clauses’ in contracts allowing a film to be flipped to a streamer for a kill fee only in the region of 10%. The spectre of such a clause was something we first reported on back at Cannes 2019 but the issue has steadily grown in prominence with the rise of the streamers. Some foreign buyers we’ve spoken to want to protect themselves from such a move by introducing clauses for much higher kill fees, guarantees of domestic theatrical distribution and the ability to negotiate directly with producers as needed. https://deadline.com/2021/03/efm-ryan-gosling-christian-bale-daisy-ridley-kevin-hart-movies-kill-fees-metoo-1234703749/

Disney CEO Bob Chapek Hints At Shorter Theatrical Windows

Disney CEO Bob Chapek suggested that the company will likely shrink the exclusive period when its films play only in theaters, though he didn’t offer any specifics. “The consumer is probably more impatient than they’ve ever been before,” he said of the market shifts during Covid-19, “particularly since now they’ve had the luxury of an entire year of getting titles at home pretty much when they want them. So, I’m not sure there’s going back. But we certainly don’t want to do anything like cut the legs off a theatrical exhibition run.” Moviegoers, he added, won’t “have much of a tolerance for a title, say, being out of theatrical for months” and “just sort of sitting there, gathering dust” before migrating to streaming or other windows.For Disney, which controls up to half the market and has released top blockbusters under the Marvel and Star Wars banners, it is not a casual decision about how long to play films in theaters. Chapek noted that a middle path — the “Premier Access” simultaneous deployment of streaming and theaters — would remain a distribution option for the foreseeable future. On Friday, animated feature Raya and the Last Dragon will go out via that method, costing $30 to subscribers to Disney+. https://deadline.com/2021/03/disney-ceo-bob-chapek-shorter-theatrical-windows-streaming-marvel-star-wars-1234704357/